From my perspective as a journalist, one of the really cool things about attending RIMS is the opportunity to have conversations with a lot of folks engaged in some really interesting issues in risk management and commercial insurance.

One such conversation I enjoyed this week was with Connie Germano, senior vp excess casualty at ACE USA in New York. The subject was nanotechnology, and her perspective on what constitute some of the key issues surrounding nanotechnology was an interesting one.

One such conversation I enjoyed this week was with Connie Germano, senior vp excess casualty at ACE USA in New York. The subject was nanotechnology, and her perspective on what constitute some of the key issues surrounding nanotechnology was an interesting one.

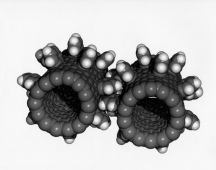

Given the work that’s going on to tap nanotechnology for everything from consumer products to medicine and the questions that remain unanswered about the potential risks associated with these molecular machines, many have questioned the possible risk exposures associated with nanotechnology, and, with those risks, the possible impact on the insurance business.

It’s not uncommon to hear someone saying nanotechnology could be “the next asbestos.”

But that sort of attitude is in fact one of the key issues that needs to be addressed if we’re to reap the benefits of nanotechnology, Ms. Germano said. While several major insurance and reinsurance companies have begun researching issues associated with nanotechnology, there are as yet no nano-specific coverages on the market, she said.

And, for some underwriters, the findings of that research might lead to “the fear stage” about nanotechnology, she said. “And they might try to exclude it as a result, which is exactly what we’re trying to avoid.”

Noting that of the $12 billion spent on nanotechnology research in the U.S. in 2005 $10 billion was spent on using nanotechnology and only $2 billion on the risks, Ms. Germano suggests that it’s critical that more research be done to identify the risks associated with nanotechnology, and then steps taken to develop appropriate standards for everything from the handling to the disposal of nano materials.

From an insurance and risk management perspective, the key to reaping the full business and societal benefits of nanotechnology is understanding any risks and managing them effectively, Ms. Germano said, adding that she doesn’t want to see the insurance industry respond to possible nanotechnology risks with “a knee-jerk reaction and just exclude it.”

“From an insurance perspective, my responsibility is to understand what’s going on in my clients’ world,” she said. “And as an insurer, my responsibility is to make sure they understand it and are addressing it to the best of their ability.”

i probably would not have guessed this was trendy one or two years ago nevertheless it’s surprising precisely how time alters the manner by which you respond to individual creative concepts, thanks with regard to the piece of writing it truly is relaxing to read something intelligent occasionally in lieu of the routine nonsense mascarading as blogs and forums on the net, i’m going to take up a couple of rounds of zynga poker, cheers

certainly like your web site but you need to check the spelling on several of your posts. Several of them are rife with spelling problems and I find it very troublesome to inform the truth then again I will surely come again again.